The Cash Flow Statement: Tracking Real Money

The "Truth-Teller" of financial health. Cash never lies.

Introduction: Why Profits Aren't Enough

A company can report millions of dollars in Net Income (profit) on its income statement and still go completely broke. How? Because profit is based on "accrual accounting," which counts sales even if the customer hasn't paid yet.

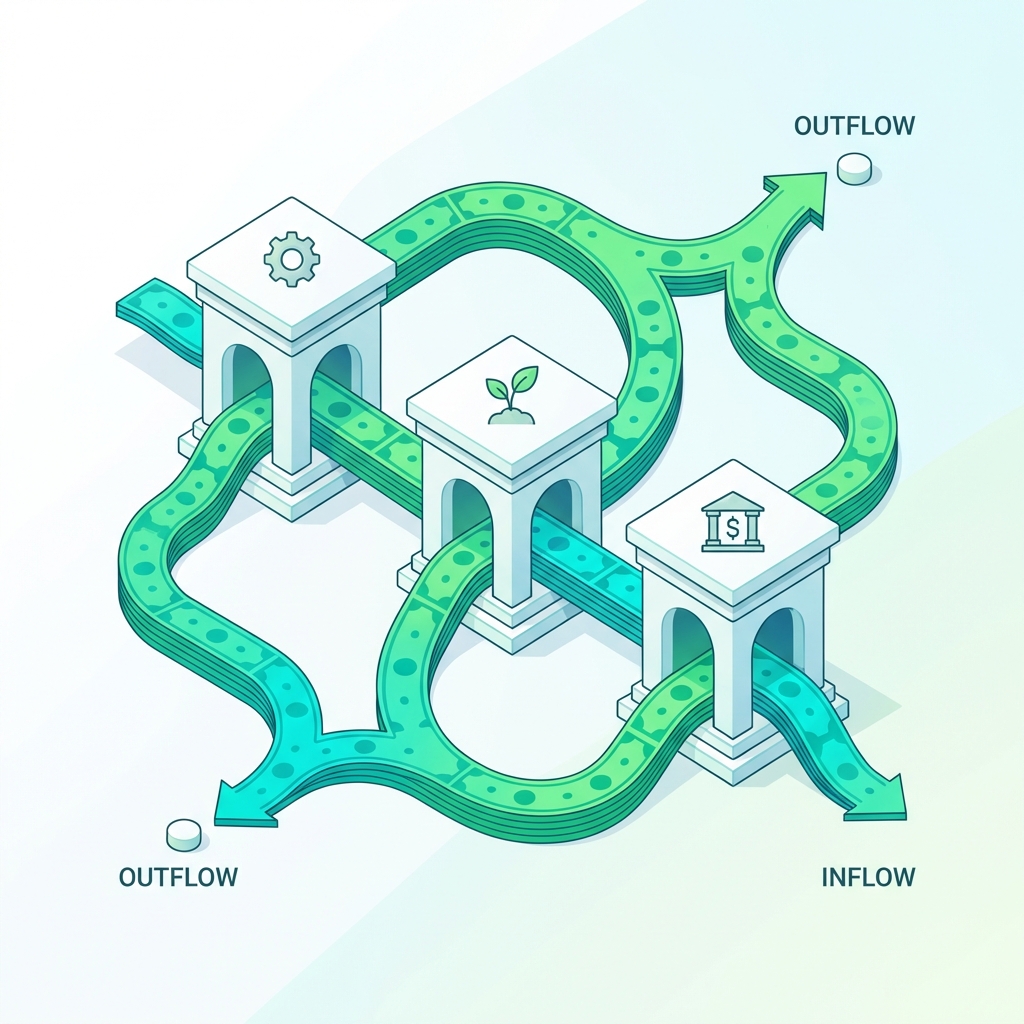

The Cash Flow Statement is the bridge between the income statement and the balance sheet. It tracks the physical movement of currency in and out of the bank account. For an intelligent investor, this is the most important report to verify if the business is real or just a paper tiger.

The Three Streams of Cash

The Three Pillars of Cash Flow: Professional Breakdown

Analysts don't just look at the final number; they look at where the cash is coming from. Under GAAP (Generally Accepted Accounting Principles), every movement is categorized:

1. Cash from Operating Activities (OCF)

This is the "Blood Flow" of the company. It starts with Net Income and adjusts for non-cash items:

- Depreciation & Amortization: Adding back "paper" expenses for wear and tear on equipment.

- Stock-Based Compensation: Adding back non-cash pay given to employees.

- Changes in Working Capital: Adjusting for timing differences in when customers pay and when the company pays its bills.

2. Cash from Investing Activities

This shows the company's future bets. It primarily tracks:

- Capital Expenditures (CapEx): Cash spent on the "real world"—buying property, plants, or software.

- Acquisitions: Cash used to buy other businesses.

3. Cash from Financing Activities

How the company is funded and how it rewards owners:

- Debt Issuance/Repayment: Taking on or paying off loans.

- Share Buybacks & Dividends: Direct cash returns to you, the shareholder.

🚩 6 Cash Flow Red Flags to Watch

Cash is harder to fake than profit, but "financial engineering" is still possible. Watch for these:

- 1. Net Income Diving, but OCF Increasing: While it looks good, check if they are just delaying payments to suppliers to artificially boost cash.

- 2. CapEx Consistently Higher than OCF: The company is spending more on "staying alive" than its core business generates. This is unsustainable.

- 3. Relying on Financing for Dividends: If "Cash from Financing" is positive because of debt, while they pay a dividend, they are essentially borrowing money to pay shareholders.

- 4. Excessive Stock-Based Compensation (SBC): If SBC is a huge chunk of OCF, the company is "paying" its employees by diluting you, the owner.

- 5. Unusual "Other Operating Cash Inflows": Always check if one-time gains are being categorized as "operating" to hide a weak core business.

- 6. Growing Accounts Receivable faster than OCF: They are making sales (Profit) but the cash isn't actually coming in.

Analyzing Like an Intelligent Investor

Free Cash Flow (FCF) - The Closest Alias to "Owner Earnings"

Warren Buffett famously coined the term "Owner Earnings." While Free Cash Flow is the metric you'll find in most stock screeners, it's important to know the distinction:

- Free Cash Flow: A standardized calculation of Operating Cash minus all Capital Expenditures.

- Owner Earnings: A more detailed concept that only subtracts maintenance CapEx (the money needed to keep the business where it is) rather than growth CapEx (money spent to expand).

For most investors, FCF is the closest and most reliable proxy we have for true owner earnings.

FCF = Operating Cash Flow - Capital Expenditures

High FCF allows a company to pay dividends, buy back shares, or acquire competitors without needing a bank's permission.

The Quality of Earnings Test

A simple test of expertise for any investor is the OCF-to-Net-Income Ratio. Ideally, this should be 1.0 or higher. If OCF is consistently lower than Net Income, the "quality" of earnings is low, suggesting accounting paper-gains rather than real cash.

Intelligent Investor Checklist: Cash Flow Edition

- ✅ Is Operating Cash Flow positive and growing?

- ✅ Is Free Cash Flow positive after accounting for CapEx?

- ✅ Does OCF cover the Dividend payments by at least 2x?

- ✅ Is the company reducing debt or buying back shares with its excess cash?

- ✅ Are "Changes in Working Capital" stable (not wildly swinging every quarter)?

Interconnectivity Tip: The Ultimate Reconciliation

The cash flow statement is the "Truth-Teller" because it must reconcile the Income Statement (starting with Net Income) with the Balance Sheet (ending with the cash balance). Any "plug" numbers or missing links here are immediate red flags for potential fraud or mismanagement.